IAAP Digital Accounting Diploma

This qualification is for those individuals who have some manual Bookkeeping and Accountancy knowledge (or those who have completed our Bookkeeping Masterclass and are keen to improve their career prospects by achieving a Digital Accounting qualification.

The qualification is also useful for those who are running their own businesses and want to maintain their business accounting records on the popular Xero Accounts software, thereby saving on accountancy fees.

The qualification enables individuals to master ALL the functionality of the popular Xero Accounts software from Xero Certified Advisors. Individuals who are already using Xero will also find the qualification to be useful as they will be able to demonstrate their expertise to would-be employers and accountancy practices which are primarily using Xero for their client’s accounts.

Individulas who achieve the diploma can apply for professional membership of the IAAP and use the designatory letters MIAAP after their name; they are even able to set up their own bookkeeping and accountancy practice on becoming a member of the IAAP.

- IAAP Digital Accounting Diploma Certificate

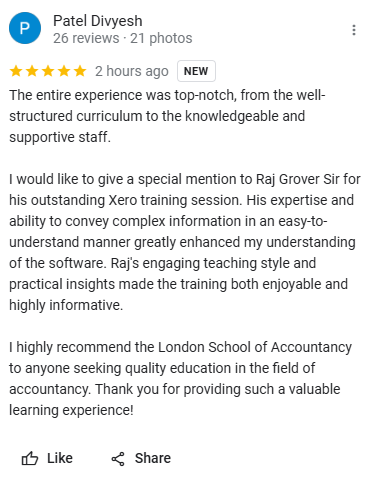

- Divyesh Patel Review – 18 June 2024

- IAAP Digital Accounting Diploma Certificate

About the IAAP Digital Accounting Diploma

The Digital Accounting Diploma certifies an individual’s expertise of the globally popular Xero Accounts software.

Xero Accounting software has 4.2 million users and is being used in more than 180 countries including New Zealand, Australia, Canada, USA, Malaysia, Dubai, etc.

It has been the accounting software of choice in the UK for over 10 years. 90% of Grover & Co. Chartered Accountants’ clients are using the Xero software for their accounting and payroll function.

1. Overview

Our extensive track record of delivering employer-led financial training enables us to deliver the IAAP Digital Accounting Diploma as a fast-track option over four days.

We are proud to be “old school” and still believe in providing tutor-led training in a classroom environment. Although, we also provide training remoteley – sometimes to clients all over the world – it is accepted that student engagement is fundamental to aid understanding of the concepts being taught and therefore interactive, in-person training is more conducive to this.

All courses are presented by qualified Chartered Accountants who are quickly able to impart their expert knowledge to all the delegates.

The advanced Digital Accounting Diploma qualification is available to learners who have completed the Intermediate Level IAAP Digital Accounting Certificate qualification or who already have extensive knowledge of Bookkeeping & Accounting. Individuals who hace successfully completed LSA’s One Day FREE Bookkeeping Masterclass can also progress to the Digital Accounting Diploma.

The Diploma qualification builds on the intermediate level qualification and introduces learners to more advanced accounting concepts and the advanced features of the Xero software including fixed assets, accruals and prepayments, accounting adjustments, etc. The emphasis will not only be on processing a wide range of business transactions from source documents but also on running KPIs and providing insightful analysis to the business owners/directors. Learners will therefore be able to undertake various period-end accounting adjustments and prepare financial statements for a private limited liability (LTD) company, carry out reconciliations and customise various management reports.

The training material is designed and presented by qualified Chartered Accountants who are quickly able to impart their practical knowledge and skills to the delegates thereby genuinely enhancing their career prospects.

The main focus of the Diploma qualification is to equip learners with advanced accounting knowledge and to make them Superusers of the increasingly popular Xero cloud accounting software.

As the qualification has been developed in conjunction with employers, accountancy practices, business owner-managers and training providers, it is very practical and hands-on. Learners will require use of the Xero Accounts software for the duration of the qualification as they will be processing a range of accounting transactions on the Xero software. 24/7 access to the Xero software for the duration of the course will be included in the course fees.

The qualification will provide learners with the required knowledge, skills and competencies in order to solely manage the finance function of a business that uses Xero Accounts software and to be able to set up their own bookkeeping or accountancy practice.

As such, on successful completion of the qualification, learners will be in a position to apply for a variety of occupations including:

Financial Accountant

Financial Controller

Finance Partner

Senior Accountant

Senior Bookkeeper

Fixed Asset Accountant

Senior Finance Officer

Chief Fianancial Officer (CFO)

Credit Controller

Comptroller

Cost Accountant

Accounts Supervisor

Management Accountant

Year End Accountant

Accounts Payable Manager

Accounts Receivable Manager

Sales Ledger Manager

Purchase Ledger Manager

Additionally, the qualification is also suitable for business owners who wish to take control and manage their own business finances and for those wanting to progress to higher education.

2. Entry Requirements & Prerequisites

It will be useful if learners have extensive Bookkeeping and Accountancy knowledge. However, learners who have successfully completed our FREE Bookkeeping Masterclass will also be able to fast-track to the Diploma qualification without undertaking the Intermediate Level qualification.

3. Progression

On successfully completing the IAAP Digital Accounting Diploma qualification, learners can progress to the Xero Payroll qualifications.

Achievement of the Diploma will enable learners to undertake more senior financial roles and to apply for membership of the IAAP (International Association of Accounting Professionals) and use the designatory letters MIAAP.

Holders of the Level 3 Diploma will also be in a position to set up their own accountancy and bookkeeping practice.

4. Qualification Syllabus

Unit 1 – Advanced Accounting Concepts

Unit 2 – Advanced Xero Accounts Setup

Unit 3 – Working with Customers in Xero (Advanced)

Unit 4 – Working with Suppliers in Xero (Advanced)

Unit 5 – Recording Bank Transactions in Xero (Advanced)

Unit 6 – Working with Fixed Assets in Xero

Unit 7 – Accounting Adjustments in Xero

Unit 8 – Working with Budgets in Xero

Unit 9 – Month End and Year End Procedure in Xero

Unit 10 – Xero Management Reports Customisation

Unit 11 – Xero Management Reports

5. Assessment

Learners will be assessed continuously throughout the course programme. The Diploma qualification consists of 11 mandatory units; learners will complete Skills & Knowledge tests (open book) throughout the training programme in order to test their understanding of the subject matter of the relevant unit.

A three hour final summative assessment will be undertaken under exam conditions which will test the learners’ practical skills. The final assessment will be a case study undertaken using the Xero Accounts software whereby the learners will assume the role of a finance manager and undertake various business transactions. Learners will be required to produce various reports as evidence of the tasks performed.

Learners successfully completing the final assessment will achieve either a Pass, Merit or Distinction; the certificate will be issued by IAAP (International Association of Accounting Professionals).

A minimum of 60% is required in the final assessment in order to achieve a Pass, 75% to achieve a Merit and 90% to achieve a Distinction.

6. Duration

The qualification can be delivered in-person in a classroom setting, online or as blended learning. It is recognised that in-person sessions are more engaging and maintain the motivation of the learners and for this reason higher success rates may be achieved by offering this option.

We are currently offering the course in-person at our training centre in west London.

With the expert guidance of a Xero Certified Advisor, the course plus examination can be completed in four days.

Ongoing support will be available via email, telephone, in-person and live online calls.

As learners will have 24/7 access to the Xero Accounts software throughout the duration of their course (as part of their course fees), they will be set regular assignments to complete in their own time in order to complement the structured training sessions.

7. Accreditation

The IAAP Digital Accounting Diploma is accredited by the prestigious IAAP (International Association of Accounting Professionals) which has a global membership. As such, the qualification has to meet the high standards of the IAAP and is inevitably highly valued by employers and the finance industry as demonstrates the successful learners’ competencies in the Xero Accounts software. Such skills are currently in high demand as there are over 4.2 million subscribers to the software; more and more employers are migrating to Xero with the demand for Xero qualified staff expected to increase further.

Accreditation will be achieved by the learner on:

1. Completing the course programme, and

2. Undertaking Skills and Knowledge tests, and

3. Successfully completing the final summative assessment and achieving a set standard.

IAAP Digital Accounting Diploma

LIMITED TIME SPECIAL OFFER

£4,250.00

Plus £100.00 for IAAP Examination Fee

- In-Person Training at Our Dedicated Centre in Ealing, London

- Face-to-Face Classroom Training

- Training by qualified Chartered Accountants

- Comprehensive Xero Training Manual

- 4 Days Intensive Training, Revision Plus Exam

- FREE 24/7, 30 Day Access to Xero Accounts Software

Course Dates

FAST-track 4 DAY PROGRamme

IAAP Digital accountiNG DIPLOMA

1. Monday 2nd, Tuesday 3rd, Monday 9th & Tuesday 10th June 2025 – (10.00 am to 4.00 pm) – Discounted Price £4,250.00

2. Saturday 14th, Sunday 15th, Saturday 21st & Sunday 22nd June 2025 – (10.00 am to 4.00 pm) – Discounted Price £4,250.00

One Day Bookkeeping Masterclass for those who do not have any prior Bookkeeping or Accounting knowledge

1. Saturday 7th June 2025 (10.00 am to 4.00 pm) – £1,250.00

2. Thursday 12th June 2025 (10.00 am to 4.00 pm) – £1,250.00